Don’t understand some business words here? Open the FAQ in another tab.

Summary of Operations

Kulicke and Soffa (K&S) makes and sells capital equipment and tools for electrical and computer parts, mainly for semiconductors.

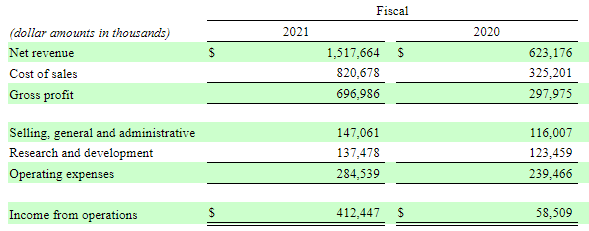

The company enjoys an operating margin of about 27%. Compared to last year’s results, they showed a good ability to increase revenues without a comparable rise in operating expenses.

The company does very little business outside of the United States and mainly makes sales to the Asia/Pacific market. Their customers are becoming increasingly concentrated, with the top ten accounting for about 60% of sales. Despite the cyclicality of their industry, they are consistently cash-flow positive.

Strategy

The company tries to stay ahead changes in demand by letting their customers try out their product and keep their feedback a part of the development process. This also strengthens their relationships with their accounts. Their balance sheet is very healthy and free of debt.

Growth and the Future

K&S believes there is room to penetrate other markets and expand their product line. Given the current semiconductor shortage, there is probably room to realize near-term growth opportunities like this. The company also has a steady buyback program and is sitting on a large pile of cash, with no looming debt. These are comforting signs.

I will, however, highlight this passage from their 10K’s Risk Factors:

Alternative packaging technologies have emerged that may improve device performance or reduce the size of an integrated circuit package, as compared to traditional wire bonding…Given that a majority of our revenue comes from wire bonding, a reduced demand for our wire bonding equipment could materially and adversely affect our financial results.

I tried to see just how risky that is, and it’s unclear. In scarcity, people may not care about these subtleties of their semiconductors, but when the cycle reverses, and supply has increased to meet demand, K&S could be vulnerable to customers who now have the luxury of choice. Buyers should keep an eye on their dependency on wire bonding, and I will do so as well going forward.

Valuation

Across the cycles of the last decade, the company has averaged about $103 million in FCF each year.

Growth Assumptions: 10% first 5 years; 5% second 5

Intrinsic Value Per Share: $20

Done reading this article? Return to the main library.